Consider a sobering truth: Most of us will eventually face a time when we need help with daily tasks, whether due to aging, illness, or injury. We're talking about long-term care, that often-overlooked expense that can quietly dismantle even the most carefully constructed retirement plans. The big question isn't if long-term care will be needed, but how it will be paid for. This guide dives deep into Who Needs Long Term Care Insurance: Eligibility and Suitability, helping you understand if this vital financial protection is right for your future.

At a Glance: Key Takeaways

- Most people need it: 70% of Americans over 65 will require some form of long-term care, with 20% needing it for over five years.

- It's expensive: Nursing homes average nearly $9,000 per month, and costs are rising.

- Medicare doesn't cover it: Standard health insurance and Medicare won't pay for extended long-term care. Medicaid only kicks in after you've spent down most of your assets.

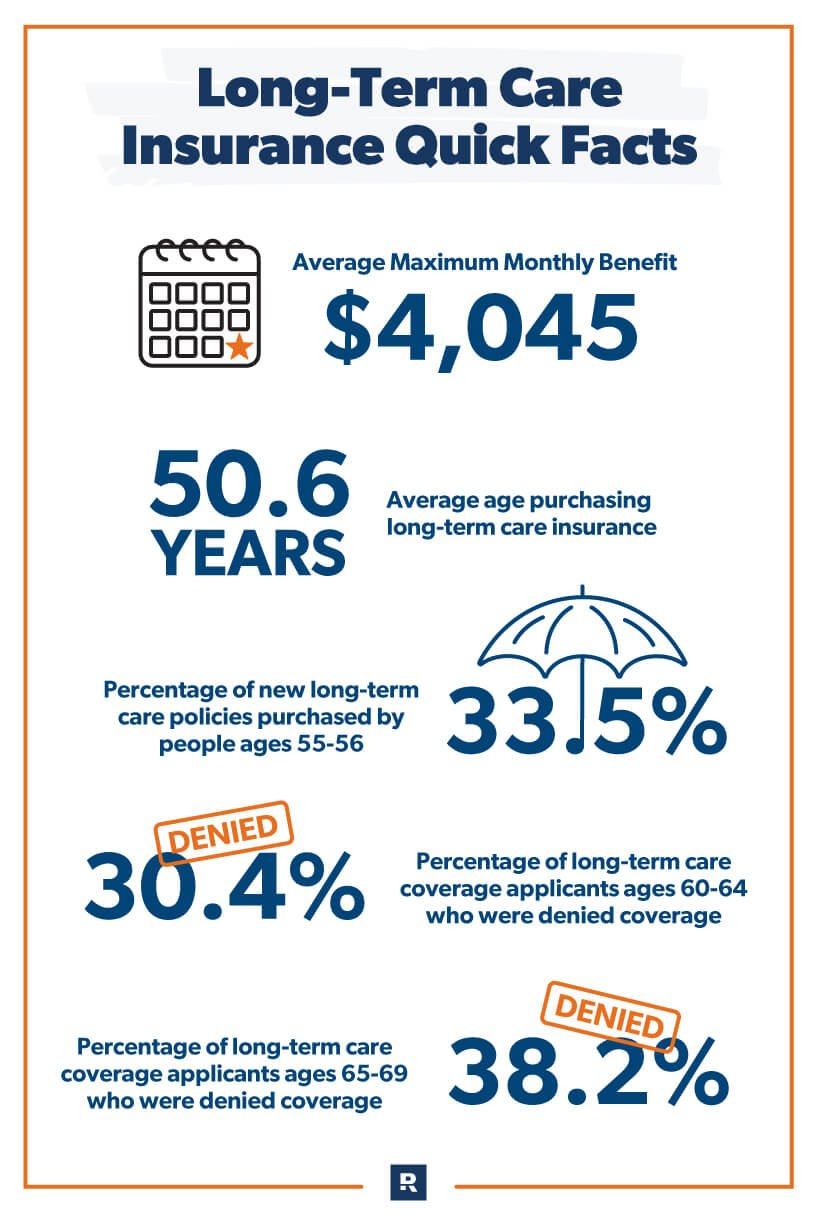

- Optimal buying age: The "sweet spot" is generally between 50 and 65, balancing lower premiums with coverage for later life.

- Health is a factor: You need to be in relatively good health to qualify, and certain pre-existing conditions or current mobility issues can disqualify you.

- Suitability depends on your finances: It's best for those who want to protect substantial retirement savings and can afford consistent premiums without hardship.

The Unavoidable Reality of Long-Term Care

Let's start with the elephant in the room: long-term care isn't just for the very old or the very frail. It's defined as any care lasting longer than three months, encompassing a wide range of services designed to help you live as independently as possible. This includes everything from skilled nursing home stays and assisted living facilities to critical in-home care, adult day care, necessary home modifications, and even professional care coordination.

The statistics are stark: an estimated 7 out of 10 Americans over the age of 65 will need some form of long-term care in their lifetime. And for a significant portion, roughly 20%, that need will extend beyond five years. This isn't just about physical care; it's about protecting your quality of life, preserving your dignity, and ensuring your wishes for care are met, wherever you choose to receive it.

Here’s the rub: these essential services come with a hefty price tag. In the U.S., a private room in a nursing home can set you back approximately $8,910 per month. That's over $100,000 a year, and those costs are only projected to climb. Imagine that expense coming out of your hard-earned retirement savings – savings you'd earmarked for travel, hobbies, or simply living comfortably. It’s enough to make anyone pause and wonder: is Long term care insurance worth it?

Understanding Long-Term Care Insurance: Your Financial Shield

So, what exactly is long-term care insurance (LTCi)? Think of it as a specialized form of protection, specifically designed to cover the significant costs associated with long-term care services that traditional health insurance and Medicare simply won't. While Medicare might cover a very limited period of skilled nursing care or home health services, it emphatically does not cover custodial care, which makes up the bulk of long-term care needs. Likewise, your regular health insurance policy isn't built for these sustained, non-medical care expenses.

Without LTCi, your options narrow considerably. You either self-fund, potentially depleting a lifetime of savings, or you rely on Medicaid. The latter, however, is a needs-based program, meaning you’ll likely have to "spend down" most of your assets to qualify, essentially liquidating your financial security before the government steps in.

Long-term care insurance steps into this crucial gap. It helps protect your retirement funds, allows you to maintain greater control over where and how you receive care – often enabling you to stay in your own home longer – and significantly reduces the immense caregiving burden on family and friends. It offers peace of mind, knowing that your loved ones can focus on being family, not full-time caregivers or financial managers. When you look at the landscape of care and the potential need for services, understanding how to best secure quality support, including finding the right long-term care provider, becomes paramount.

Who Is Long-Term Care Insurance Truly For?

Deciding when and if to buy LTC insurance is a deeply personal financial and health decision. While it's clear that a vast majority will need some form of care, the timing and suitability vary.

The "Sweet Spot" for Purchase: Ages 50-65

Most experts agree that the optimal time to purchase long-term care insurance falls within a specific age range: roughly between 50 and 65. Why this window?

- Health: At 50, you're more likely to be in good health, making you eligible for coverage and able to secure lower premiums. As you age, the risk of developing a disqualifying condition increases significantly.

- Affordability: Buying earlier means you lock in lower premiums over the policy’s lifetime. While you’ll pay for more years, the annual cost is considerably less than if you wait.

- Needs vs. Cost: Data shows that 92% of LTC claims are filed by individuals over 70, with most new claims starting after age 80. Buying in your 50s or early 60s means you’re paying premiums for a reasonable period before the highest likelihood of needing care kicks in, without paying for too long.

Why Earlier Might Be Better: Locking in Rates and Family History

You might consider purchasing LTC insurance even earlier than 50 if certain factors apply to you. If you have a family history of early-onset illnesses like Alzheimer's or Parkinson's, or if there's a pattern of significant health issues emerging in your family in your 50s, securing a policy earlier could be a strategic move. This allows you to lock in those lower premiums while you're still in peak health, potentially sidestepping future eligibility challenges.

Why Waiting Is a Gamble: Health Changes and Uninsurability

Delaying your decision carries significant risks. The longer you wait, the higher your premiums will be. More critically, waiting too long drastically increases your chances of developing a health condition that could make you uninsurable. Even a seemingly minor health event or a new diagnosis in your late 60s or 70s could mean the difference between qualifying for a policy and being outright denied. Once you've developed certain health issues, the opportunity to purchase this protection might be gone forever.

Eligibility Essentials: Are You Insurable?

Unlike general health insurance, long-term care insurance isn't guaranteed issue. Insurers carefully assess your health and functional abilities to determine your eligibility and set your premiums.

Good Health Is Key

Generally, to be eligible for LTC insurance, you need to be in relatively good health. Most policies are available to adults aged 18-75, though practical considerations often point to the 50-65 age window as most advantageous. Insurers undertake a thorough underwriting process that typically involves:

- Reviewing Medical Records: They'll look at your full medical history, prescriptions, and any past diagnoses.

- Medical Exam: A physical examination might be required to assess your current health status.

- Cognitive Assessment: Screening for memory problems or signs of cognitive decline is standard.

- Activities of Daily Living (ADLs) Assessment: This is a crucial component of eligibility and benefits.

The ADL Test: What Insurers Look For

The ability to independently perform Activities of Daily Living (ADLs) is the cornerstone of both eligibility for LTC insurance and triggering its benefits. Insurers look at your capacity to manage these six fundamental tasks without significant human assistance:

- Bathing: Getting in and out of a tub or shower and washing yourself.

- Dressing: Putting on and taking off clothes.

- Eating: Getting food from a plate into your mouth.

- Toileting: Getting to and from the toilet, and maintaining personal hygiene.

- Continence: Maintaining control of bladder and bowel function.

- Transferring: Moving from a bed to a chair, or walking across a room.

If you already need assistance with two or more ADLs, you will almost certainly be deemed ineligible for a new LTC insurance policy. This highlights the importance of applying while you are still independent and healthy. Keep in mind that when a policy's benefits eventually kick in, typically it's also triggered by the inability to perform a certain number of ADLs or severe cognitive impairment. Beyond the ADLs, another important consideration for policy activation is understanding elimination periods, which dictate how long you pay for care out-of-pocket before benefits begin.

When Long-Term Care Insurance Might Not Be an Option (Disqualifying Factors)

While many people qualify, specific health conditions or current limitations can make you uninsurable for long-term care insurance. These factors represent a level of risk that insurers are generally unwilling to take on for a new policy.

Current Health Challenges

If you are already relying on certain mobility aids for daily living, it's a strong indicator to insurers that you may soon need long-term care, making you a high-risk applicant. Disqualifying factors often include:

- Current reliance on mobility aids such as a three-pronged cane, crutches, oxygen, walker, or wheelchair for daily movement.

- Already needing assistance with any of the Activities of Daily Living (ADLs) mentioned above.

Cognitive Concerns

Signs of cognitive decline or memory problems are significant red flags for insurers, given the high cost and long duration of care often associated with conditions like dementia. This can include:

- Any formal diagnosis of memory loss.

- Observable signs of cognitive decline or dementia.

Specific Medical Conditions

Certain pre-existing conditions are almost universally disqualifying due to their severe and progressive nature, and the high likelihood of requiring extensive long-term care. These include:

- AIDS/HIV

- Alzheimer’s disease

- Cancer (depending on type, stage, and recent treatment – some insurers may accept applicants with a history of successfully treated, non-aggressive cancers after a waiting period)

- Dementia

- Kidney failure (requiring dialysis)

- Mid to advanced multiple sclerosis

- Paralysis

- Parkinson’s disease

- Schizophrenia

- History of multiple strokes or a recent significant stroke

Age as a Barrier

While eligibility technically extends up to age 75 for some insurers, the practical reality is that older applicants face steeper hurdles and significantly higher premiums. Many insurers may limit new policies to those under 70 or even 65, reflecting the increasing health risks associated with advanced age. If you've waited into your late 60s or 70s, your options will be fewer and much more expensive, assuming you still qualify health-wise.

Suitability: Should YOU Buy Long-Term Care Insurance?

Even if you're eligible, the next question is: is it suitable for your personal circumstances? This goes beyond simply qualifying and delves into your financial situation, family dynamics, and risk tolerance.

Financial Factors

Long-term care insurance is a significant financial commitment. It's designed to protect your assets, but only if you can comfortably afford the premiums.

- Income and Assets: If you have substantial retirement savings, investment portfolios, or significant equity in your home that you wish to protect from potential care costs, LTC insurance is a strong candidate. It acts as a shield, preserving your legacy and financial independence. Conversely, if your assets are limited and you would likely qualify for Medicaid relatively quickly, the cost of premiums might outweigh the benefit.

- Affordability: Can you consistently pay the annual premiums without it becoming a financial burden? Remember, these are ongoing costs that could last for decades. If paying premiums strains your budget, it might not be the right fit. It's worth investigating the potential tax benefits of LTC insurance, as premiums may be tax-deductible up to certain limits, which could impact overall affordability.

Family & Support System

Your family situation and personal preferences play a crucial role in determining suitability.

- The Caregiving Burden: Do you have family members nearby who are willing and able to provide extensive care, or would you prefer professional care to reduce that burden? For many, LTC insurance is an expression of love, allowing children and spouses to remain family members rather than becoming full-time caregivers.

- Personal Preferences: Do you value having choices in your care settings? Do you want to stay in your home as long as possible with professional support? LTC insurance offers greater flexibility and control over your care decisions, rather than being limited by financial constraints or reliance on family.

Risk Tolerance

How comfortable are you with financial uncertainty, especially regarding healthcare costs?

- Planning for the Unknown: Some individuals prefer to plan for every contingency, viewing LTC insurance as a critical safety net against potentially catastrophic expenses.

- Self-Insuring: Others might choose to "self-insure" by setting aside a dedicated pool of money for future care needs. This strategy requires significant liquid assets and strict financial discipline. However, it also carries the risk that care costs could exceed your fund, or that you might need to tap into those funds for other emergencies.

Navigating Your Options: Choosing the Right Policy

If you've determined that long-term care insurance is a suitable option for you, the next step is to select a policy that aligns with your budget and future care needs. This isn't a one-size-fits-all purchase; policies offer various features and benefits.

Policy Type Considerations

When comparing policies, look at these key components:

- Daily or Monthly Benefit Amount: This is the maximum amount the policy will pay for care each day or month. Choose an amount that reflects the average cost of care in your area.

- Benefit Period: This dictates how long the policy will pay benefits (e.g., 2 years, 5 years, unlimited lifetime). A longer benefit period offers more protection but comes with higher premiums.

- Inflation Protection: This is a crucial rider that increases your daily or monthly benefit over time to account for rising care costs. It's often offered as a 3% or 5% compound annual increase. While it adds to your premium, it's highly recommended, as care costs historically outpace general inflation.

- Elimination Period: Also known as the waiting period, this is the number of days you must pay for care out-of-pocket before the insurance company begins to pay. Common periods are 30, 60, 90, or 180 days. A longer elimination period will result in lower premiums, but only choose this if you are confident you can cover three to six months of care expenses out of your own pocket. This strategy can significantly impact affordability.

Understanding these variables, along with exploring different types of long-term care insurance policies, is essential for tailoring coverage to your specific situation. For instance, hybrid policies combine LTC coverage with life insurance, offering a death benefit if long-term care isn't needed.

Consulting an Independent Agent

Given the complexity of long-term care policies, it's highly advisable to consult an independent insurance agent. These professionals work with multiple insurance carriers, allowing them to:

- Compare Options: They can help you compare various policies, features, and riders from different companies.

- Obtain Quotes: They can provide personalized quotes based on your age, health, and desired coverage.

- Explain Nuances: They can clarify confusing policy language and help you understand the pros and cons of different choices.

- Advocate for You: An independent agent acts as your advocate, ensuring you find the best coverage for your unique situation.

Common Questions & Misconceptions About LTC Insurance

Navigating the world of long-term care can be confusing, and many misconceptions abound. Let's clear up some of the most common ones.

"Doesn't Medicare Cover This?"

Answer: No, not for ongoing long-term care needs. Medicare primarily covers medically necessary care, such as short-term skilled nursing care after a hospital stay or limited home health services. It does not cover "custodial care," which is the bulk of long-term care—assistance with ADLs like bathing, dressing, or eating—when it's the only care you need.

"I'll Just Use Medicaid."

Answer: While Medicaid does cover long-term care for those who qualify, it's a safety net for the impoverished. To be eligible, you typically must spend down nearly all your assets (excluding your primary residence and a small amount of savings). This means liquidating savings, investments, and other valuable possessions before Medicaid benefits kick in. Relying on Medicaid as a primary plan means sacrificing financial independence and control over your care choices.

"It's Too Expensive."

Answer: The cost of LTC insurance varies widely based on age, gender, health, and policy specifics. For example, a 60-year-old man might pay an average of $1,200 per year for $165,000 in coverage, while a 60-year-old woman might pay around $1,960 annually. While these are not insignificant sums, they are often a fraction of what you would pay out-of-pocket for actual long-term care. Compare the annual premium to nearly $9,000 per month for nursing home care. The investment helps avoid potentially catastrophic expenses that could wipe out your entire retirement fund.

"I'm Too Young/Healthy."

Answer: This is a common and dangerous misconception. As we discussed, the "sweet spot" for purchasing is between ages 50 and 65, precisely when you are still relatively young and healthy. Waiting until you're older or have health issues often means you'll pay much higher premiums or be denied coverage altogether. The goal is to secure coverage before you need it, when you're insurable and rates are more favorable. Furthermore, for those who find traditional LTC insurance unfeasible or prefer different planning methods, it's prudent to explore alternatives to traditional LTC insurance to ensure some form of protection is in place.

What If You Don't Qualify or Can't Afford It?

Even if traditional LTC insurance isn't an option, either due to health disqualifications or financial constraints, that doesn't mean you're without options for long-term care planning.

- Hybrid Policies: These policies combine long-term care coverage with life insurance or an annuity. If you need LTC, the benefits are paid out. If you don't, your beneficiaries receive a death benefit or you get a return on your premium. They often have less stringent underwriting than standalone LTC policies.

- Self-Insurance/Personal Savings: If you have substantial liquid assets, you might choose to self-insure by earmarking a portion of your savings specifically for future care costs. This requires discipline and the understanding that care costs could potentially exceed your reserves.

- Medicaid Planning: For those with very limited assets, strategic Medicaid planning (often with the help of an elder law attorney) can help ensure you qualify for benefits without losing everything. This is a complex area and requires careful navigation well in advance of needing care.

- Family Care Agreements: In some cases, families formalize agreements where a family member provides care in exchange for compensation, which can sometimes be structured to avoid asset spend-down issues if Medicaid eventually becomes necessary.

Your Next Steps: A Clear Path Forward

Understanding who needs long-term care insurance, as well as the eligibility and suitability factors, is the first crucial step in protecting your future. This isn't just about financial planning; it's about preserving your independence, protecting your dignity, and easing the potential burden on your loved ones.

Don't wait until a health event forces the issue. Start the conversation today.

- Assess Your Health: Honestly evaluate your current health and family medical history. Are you in that "sweet spot" for eligibility?

- Review Your Finances: How much do you have in retirement savings you want to protect? Can you comfortably afford annual premiums?

- Discuss with Family: Talk to your loved ones about your wishes for future care and their potential role.

- Consult a Professional: Reach out to an independent insurance agent who specializes in long-term care. They can provide personalized advice, compare policies, and walk you through the application process without obligation.

By proactively addressing the need for long-term care planning, you're not just buying an insurance policy; you're investing in your peace of mind and securing the future you envision.