When the golden years arrive, they often bring not just wisdom and experience, but also an uncomfortable truth: the potential need for long-term care. This isn't just a concern for the very old; chronic illness, unexpected accidents, or conditions like Alzheimer's can strike at any age. Without a plan, the staggering costs can derail even the most carefully laid financial strategies, leaving families stressed and legacies diminished. This is precisely where The Financial Benefits and Prote protections of LTC Insurance step in, offering a vital shield against an uncertain future.

It's about much more than just paying bills; it's about preserving dignity, independence, and the financial well-being of you and your loved ones. Long-term care insurance (LTCi) provides a powerful solution, covering the specialized services—from help with daily tasks like bathing and dressing to skilled nursing—that Medicare and standard health insurance typically leave unaddressed.

At a Glance: Why LTC Insurance Matters

- Protects Your Savings: Safeguards your retirement accounts, investments, and home from being depleted by care costs.

- Preserves Independence: Gives you control over where and how you receive care, offering more choices than just nursing homes.

- Eases Family Burden: Finances professional care, alleviating the emotional and physical strain on family members.

- Provides Peace of Mind: Reduces anxiety about potential future care needs and their financial impact.

- Offers Financial Security: Prevents reliance on government programs like Medicaid, which often have strict asset limitations.

- Potential Tax Advantages: Premiums may be tax-deductible for qualified policies, and benefits are generally tax-free (consult a tax advisor).

The Unseen Tsunami: Understanding Long-Term Care Costs

Imagine needing daily assistance for basic tasks – perhaps due to a fall, a debilitating illness, or the onset of dementia. While your health insurance covers doctor visits and hospital stays, it typically won't pay for extended custodial care. That means the cost of living in an assisted living facility, receiving skilled nursing in a nursing home, or even hiring professional caregivers to come to your home, falls squarely on your shoulders.

And those costs are substantial and rapidly rising. In 2024, a private room in a nursing home averages around $9,400 per month nationally, adding up to over $112,000 annually. For many, that's equivalent to a second mortgage payment or more. A sobering projection indicates that the national average for just three years of long-term care, currently around $318,000, could nearly double to an estimated $633,000 by 2044. These figures aren't just statistics; they represent a very real threat to your financial stability.

The reality is stark: without a plan, these costs can quickly decimate a lifetime of savings, force the sale of beloved assets, and dramatically alter the financial security of your spouse and the legacy you hoped to leave your heirs.

Beyond the Bills: The Real Financial Benefits and Protections of LTC Insurance

The value of long-term care insurance extends far beyond merely cutting checks for services. It offers a multifaceted layer of protection that impacts every aspect of your financial and personal well-being.

Shielding Your Hard-Earned Assets

One of the most significant benefits of LTC insurance is its ability to act as a formidable barrier between your long-term care expenses and your personal wealth. Your retirement accounts, investment portfolios, and even the equity in your home are precisely what LTCi is designed to protect.

Consider this: without LTC insurance, a few years in a nursing home could easily consume hundreds of thousands of dollars, wiping out retirement savings meant to last decades. This often forces families into difficult decisions, such as selling assets at unfavorable times or exhausting resources until they qualify for Medicaid – a program with strict income and asset limits that offers fewer choices in care providers. With LTC insurance, you transfer this immense financial risk to an insurer, safeguarding your nest egg for its intended purpose: a comfortable retirement and a lasting legacy.

Preserving Your Independence and Control Over Care Choices

The thought of losing control over your life and care decisions is daunting. LTC insurance empowers you to retain that independence. Instead of being limited to the care options covered by government programs or what your family can physically and financially provide, LTCi opens up a world of possibilities.

You gain the freedom to choose:

- In-home care: Remaining in the comfort and familiarity of your own home, receiving professional assistance with daily tasks.

- Assisted living facilities: A balance of independence and support in a community setting.

- Adult day care: Providing social engagement and care during the day while family caregivers work.

- Home modifications: Covering costs for ramps, grab bars, or other changes that make your home safer and more accessible.

This control isn't just about comfort; it's about dignity. It ensures that your preferences are met, and your quality of life is maintained on your terms, not dictated by financial constraints.

Alleviating the Burden on Loved Ones

The emotional and physical toll on family caregivers can be immense. While family members often step up out of love, providing continuous long-term care is a full-time job that can lead to burnout, stress, and even force them to sacrifice their own careers or financial stability.

LTC insurance provides the funds for professional care, effectively easing this profound burden. It allows your children, spouse, or other family members to remain just that – family – rather than becoming overwhelmed caregivers. They can focus on providing emotional support and enjoying quality time with you, knowing that your physical needs are being met by trained professionals. This protection safeguards not only your financial health but also the well-being and relationships within your family.

Protecting Your Spouse's Financial Security

The ripple effect of long-term care costs can be devastating for a surviving spouse. If one partner requires extensive care, the shared assets intended for their joint retirement can quickly dwindle, leaving the healthy spouse in a precarious financial position. This jeopardizes their ability to maintain their lifestyle, cover their own future expenses, and enjoy the retirement they both planned for.

LTC insurance ensures that one spouse's care needs don't bankrupt the other. It acts as a dedicated pool of funds, preserving the couple's collective wealth and protecting the healthy spouse's continued financial security, allowing them to live out their years with dignity and less financial strain.

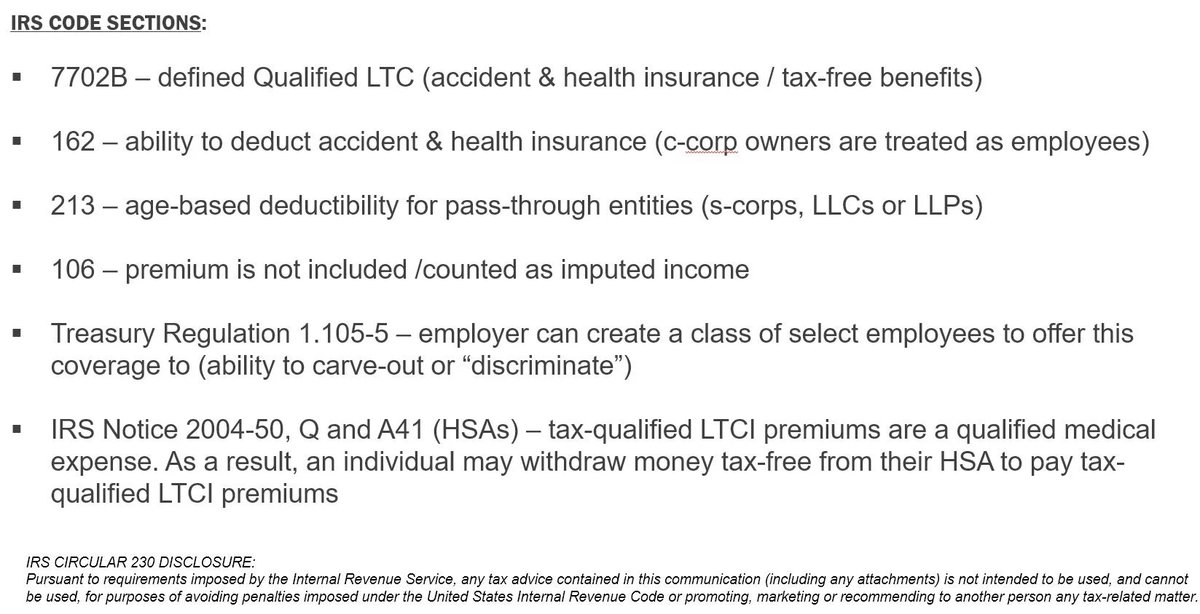

Potential Tax Advantages

For many, the financial incentives of LTC insurance can be significant. Premiums paid for "qualified" long-term care policies may be tax-deductible as medical expenses, subject to IRS limits based on age. Furthermore, the benefits received from these policies are generally not considered taxable income. This can represent a substantial saving, making the policy even more attractive. Always consult with a qualified tax advisor to understand how these benefits apply to your specific situation.

Navigating the Landscape: Different Ways to Secure Your Future

Long-term care insurance isn't a one-size-fits-all product. The market has evolved to offer several types of coverage, each designed to meet different financial goals and risk tolerances. Understanding these options is key to making an informed decision. For a deeper dive into whether this type of coverage aligns with your personal circumstances, consider "Understanding long term care insurance."

1. Traditional Long-Term Care Insurance

This is what most people picture when they hear "LTC insurance." You pay regular premiums, and in exchange, the policy provides a set daily or monthly benefit amount for a specified period (e.g., three years, five years, or even lifetime) if you qualify for care.

Key characteristics:

- Benefit Structure: Pays a fixed amount up to a lifetime maximum.

- Premium Potential: Premiums may increase over time, depending on the policy and insurer.

- "Use It or Lose It": If you never need long-term care, the premiums you've paid are generally not returned.

Traditional policies offer comprehensive coverage and can be very cost-effective if purchased at a younger, healthier age.

2. Life Insurance with an LTC Rider (Hybrid Policies)

These policies combine the benefits of life insurance with long-term care coverage, offering a "no-lose" proposition for many. You essentially get a life insurance policy that also has a built-in mechanism to pay for long-term care.

Key characteristics:

- Accelerated Death Benefit: The LTC rider allows you to "accelerate" or tap into the life insurance death benefit while you're still alive to cover long-term care expenses.

- Guaranteed Payout: If you don't need long-term care, the full, tax-free death benefit is paid to your beneficiaries.

- Premium Stability: Premiums can often be flexible or guaranteed not to increase, providing more predictability.

- Funding Options: Can sometimes be funded with a single lump-sum payment or through ongoing premiums.

Hybrid policies appeal to those who want the peace of mind of LTC coverage without the risk of "losing" their premiums if care is never needed, ensuring a payout one way or another.

3. Long-Term Care Annuity

Annuities traditionally offer tax-deferred growth and guaranteed income streams. A long-term care annuity takes this a step further, integrating enhanced benefits specifically for long-term care expenses.

Key characteristics:

- Leveraged Benefits: A single investment (e.g., $100,000) can often yield two to three times that amount in long-term care benefits (e.g., $200,000 to $300,000).

- Premium Stability: Premiums are typically a one-time lump sum and do not increase.

- Estate Protection: If you don't need care, the cash value (or a death benefit) passes to your beneficiaries.

- Tax Efficiency: Can sometimes be funded via a 1035 exchange from an existing annuity or life insurance policy, or even directly from an IRA, offering tax-advantaged growth.

- Unlimited Options: Some policies even offer unlimited benefits, providing unparalleled peace of mind.

LTC annuities are a powerful option for those with existing assets they wish to reposition for long-term care protection, often providing greater leverage than traditional investment returns for care costs.

4. Short-Term Care Insurance

As the name suggests, this type of policy covers long-term care needs for a shorter duration, typically a year or less.

Key characteristics:

- Affordable: Generally less expensive than traditional LTC insurance.

- Accessibility: Easier to qualify for, making it suitable for those who might not meet the health requirements for traditional policies or have missed age limits.

- Limited Coverage: Provides a bridge for immediate or short-term care needs, but not comprehensive, extended care.

Short-term care insurance can be a valuable option for individuals seeking some level of protection, perhaps to cover the elimination period of a traditional policy, or as a more accessible alternative when other options are out of reach.

Crunching the Numbers: What Long-Term Care Actually Costs (and How to Protect Against It)

The cost of long-term care is a moving target, constantly increasing with inflation and demand. As we've seen, the national average for three years of care is currently $318,000, projected to surge to $633,000 in two decades. These are the expenses you're protecting yourself against.

Understanding Premiums

The cost of an LTC insurance policy depends on several factors, primarily:

- Age: The younger you are when you buy, the lower your premiums.

- Health: Better health typically means lower premiums and easier qualification.

- Gender: Women often pay more than men due to longer life expectancies. For example, a 60-year-old man might pay around $1,200 per year, while a woman the same age might pay $2,200.

- Policy Features: Benefit amount, benefit period, elimination period, and inflation protection all influence the premium.

The Crucial Role of Inflation Protection

When considering a policy, inflation protection is not just an add-on; it's a necessity. Without it, a policy purchased today might offer a daily benefit that looks generous now, but could be woefully inadequate 20 or 30 years down the line when care costs have inevitably risen.

While adding inflation protection will increase your initial premium, it's a vital investment that ensures your coverage keeps pace with rising care expenses. Options typically include a fixed percentage increase (e.g., 3% or 5% compounded annually) or an increase tied to an index. Ignoring inflation is akin to buying an umbrella that only covers your head in a downpour; you're still going to get wet.

The Self-Insuring Debate: A Financial Showdown

Many financially savvy individuals might consider "self-insuring" – setting aside a significant sum in investments to cover potential long-term care costs. While this is an option, it comes with its own set of considerations and risks compared to dedicated LTC insurance products.

Let's look at a practical comparison, using the ground truth provided:

| Scenario | Initial Investment | 20-Year Growth (approx.) | Available for LTC (Day One) | Available for LTC (20 Years) | Estate Payout (No Care) | Tax Implications |

|---|---|---|---|---|---|---|

| Self-Insuring | $100,000 | $387,000 (at 7% annual) | $100,000 | $387,000 | $387,000 | Gains typically taxable |

| LTC Annuity | $100,000 | N/A | $407,340 | $574,592 | $142,265 | Benefits tax-free, estate payout tax-free |

| As this comparison illustrates, an LTC annuity offers immediate leverage for care costs that traditional investments simply cannot match. On day one, your $100,000 investment immediately translates to over $400,000 in tax-free care benefits, a quadrupling of your initial outlay. In 20 years, that grows to nearly $575,000. If you never need care, your beneficiaries still receive a significant tax-free death benefit. | ||||||

| The key difference lies in risk transfer and leverage. With self-insuring, you bear 100% of the risk, and your money grows at market rates, subject to market fluctuations and taxes. With LTC insurance, you transfer the risk of catastrophic care costs to an insurer, and in the case of hybrid or annuity products, you gain significant leverage on your investment, often providing tax-free benefits far exceeding what you could accumulate on your own over the same period. This allows your other investments to remain intact for their intended purposes. |

Your Window of Opportunity: When to Act on LTC Insurance

The decision of when to buy long-term care insurance is almost as important as the decision to buy it at all. Unlike other types of insurance you might purchase later in life, timing is critical for LTCi.

The sweet spot for purchasing LTC insurance typically falls in your 50s or early 60s. Here's why:

- Affordable Rates: The younger and healthier you are when you apply, the lower your annual premiums will be. Premiums are generally locked in (or have more predictable increases for traditional policies) at the age you purchase, making a significant difference over decades.

- Improved Qualification Chances: LTC insurance is medically underwritten. As we age, the likelihood of developing health issues increases. Conditions like diabetes, heart disease, or even certain medications can make you ineligible for coverage or significantly increase your premiums. Applying while you're still in good health vastly improves your chances of qualifying for a policy at the best rates.

- Maximum Benefit from Premiums: Buying earlier means you'll pay premiums for a longer period, but the total amount paid might still be less than if you waited until you were older and faced much higher rates. More importantly, you'll have coverage in place for a longer duration, ready if an unforeseen event occurs.

Who Should Consider LTC Insurance?

LTC insurance is an excellent option for a broad range of individuals:

- Those who don't qualify for Medicaid but lack sufficient assets: If your income and assets are too high for Medicaid but not enough to cover several years of care out-of-pocket without significant financial strain, LTC insurance is a critical solution.

- Individuals seeking to protect their assets: Whether you have a modest nest egg or substantial wealth, LTC insurance acts as a safeguard, ensuring your hard-earned money isn't depleted by care costs.

- High-net-worth individuals: Even those with significant assets often choose LTC insurance to transfer risk and prevent the liquidation of investments or real estate to cover care expenses. It's a strategic move to preserve generational wealth.

- Anyone who wants control and peace of mind: If you value maintaining your independence and having a say in your care choices, rather than being limited by financial constraints or government programs, LTC insurance is for you.

Waiting to buy increases costs and the risk of ineligibility. The best time to secure your future is when health is on your side.

Crafting Your Shield: Key Considerations for Your Policy

Once you've decided to explore long-term care insurance, you'll encounter several important policy features. Understanding these will help you tailor a plan that fits your specific needs and budget.

- Benefit Amount (Daily or Monthly): This is the maximum amount the policy will pay for your care each day or month. Consider the average cost of care in your area and project how much you might need in the future. Will you need $200 a day for in-home care, or $300+ for a private nursing home room?

- Benefit Period: This dictates how long the policy will pay benefits (e.g., 3 years, 5 years, or for your lifetime). The longer the benefit period, the higher the premium. Consider your family history and potential longevity.

- Elimination Period (Deductible): This is the waiting period (e.g., 30, 60, or 90 days) from when you become eligible for benefits until the policy actually starts paying. You'll need to cover care costs out-of-pocket during this time. A longer elimination period generally results in lower premiums.

- Inflation Protection: As discussed, this is crucial. It ensures your benefit amount grows over time to keep pace with rising care costs. Without it, a policy that seems sufficient today could be inadequate decades from now.

Getting Expert Guidance

Navigating the complexities of LTC insurance options, comparing policies, and understanding the fine print can be overwhelming. This is where an experienced, independent insurance broker becomes invaluable. They can:

- Assess your individual needs and financial situation: Help you determine what level of coverage makes sense for you.

- Compare multiple insurers and policy types: Find the best rates and features from various providers, including traditional, hybrid, and annuity options.

- Clarify policy details: Explain the nuances of benefit triggers, elimination periods, and inflation riders.

- Advise on tax implications: Help you understand potential deductions and tax-free benefits (though always defer to a tax advisor for specific advice).

Their expertise ensures you select a plan that is not just affordable but truly effective in providing The Financial Benefits and Protections of LTC Insurance you're seeking.

Taking the Next Step Towards Security

The discussion around long-term care can feel heavy, but the decision to plan for it is empowering. Long-term care insurance isn't just another financial product; it's a proactive step towards preserving your independence, protecting your financial legacy, and ensuring peace of mind for both you and your loved ones.

Don't wait until a health event forces your hand. Take the initiative now to explore your options. Review your current financial situation, consider your future care preferences, and speak with a trusted financial advisor or an independent insurance broker specializing in long-term care. They can help you understand the nuances of policies, compare quotes, and guide you towards a solution that provides the robust financial benefits and protections you deserve. Securing your future is a journey, and planning for long-term care is an essential step on that path.