Facing the prospect of needing long-term care later in life can be daunting, a future often envisioned with a mix of anxiety and uncertainty. We want to protect our loved ones, preserve our hard-earned assets, and ensure dignity in our golden years. Long-Term Care Insurance (LTCI) often emerges as a potential solution, promising financial peace of mind. But like any complex financial product, it’s not a one-size-fits-all magic bullet. Before you commit to decades of premiums, it's crucial to shine a light on the potential downsides and risks of long-term care insurance. Understanding these complexities isn't about discouraging planning, but empowering you to make the most informed decision for your unique situation.

At a Glance: Key Downsides and Risks of LTCI

- High and Rising Premiums: Initial costs can be significant, and insurers can increase rates on a class-wide basis, potentially by 20-40% or more, straining fixed incomes.

- Paying for Unused Benefits: You might pay premiums for decades without ever needing long-term care, essentially "losing" your investment.

- Complex Policy Terms: Policies are filled with intricate conditions, waiting periods, benefit triggers (like inability to perform Activities of Daily Living, or ADLs), and exclusions that can be difficult to navigate.

- Limited Coverage Periods & Caps: Many policies cap the total dollar amount or duration of benefits, which may not cover prolonged or extremely expensive care needs.

- Strict Underwriting: Obtaining coverage can be challenging, with insurers often denying policies or charging much higher rates for individuals with certain pre-existing conditions.

- Opportunity Cost: The money spent on premiums could potentially be invested elsewhere, offering returns or greater flexibility for any future financial need.

- Restrictions on Care: Some policies limit the types of care or facilities covered, potentially reducing flexibility and choice when you need it most.

Why Long-Term Care Insurance Exists (and Why It's So Complex)

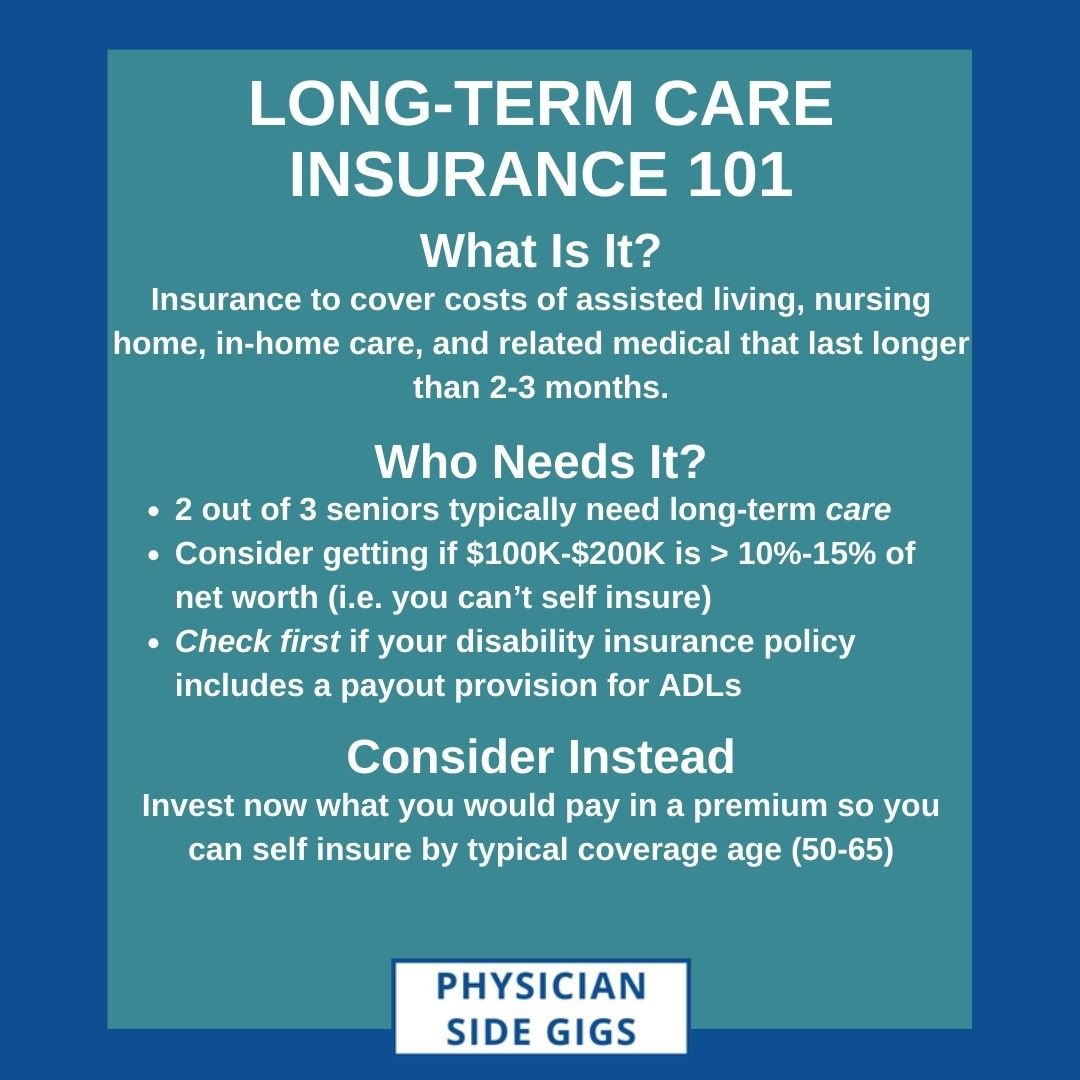

Before diving into the pitfalls, a quick refresher on LTCI's purpose can clarify why these risks even exist. Long-term care involves assistance with daily living activities (like bathing, dressing, eating) or intensive medical care, whether in your home, an assisted living facility, or a nursing home. These services are almost universally not covered by traditional health insurance or Medicare. While Medicaid does cover long-term care, it's strictly for individuals with very limited financial means, often requiring a "spend down" of assets.

LTCI aims to bridge this gap, protecting your financial assets from the staggering costs of care and preserving your wealth for your beneficiaries. It offers flexibility in choosing care options and can alleviate the immense physical and financial burden on family members. The peace of mind it offers is often cited as a primary benefit.

However, providing this kind of comprehensive, future-proof protection is inherently challenging and expensive for insurers, leading directly to the complexities and risks we're about to explore.

The Financial Minefield: High Premiums and Uncertain Costs

One of the most immediate and significant hurdles for potential LTCI policyholders is the financial commitment. It's a long-term investment that demands careful budgeting and a clear understanding of what you're signing up for.

High Initial Premium Costs

Long-term care insurance isn't cheap. Premiums are influenced by your age, health, the amount of coverage you desire, and the features you add (like inflation protection). The younger and healthier you are when you buy, the lower your initial premiums will be.

For instance, in 2022, a 55-year-old man purchasing $165,000 worth of LTCI coverage paid an average of $2,220 per year. For a 65-year-old, that annual premium could jump to $3,745, and by 75, it could be $7,700 or more. While women typically pay less than men due to longer life expectancies (statistically meaning more years to pay premiums), the costs are still substantial. These are not trivial expenses; they represent a significant annual outlay for decades.

The Unsettling Specter of Rising Premiums

Perhaps even more concerning than the initial premium is the very real risk of future rate hikes. Unlike auto or home insurance, where individual claim history can impact your rates, LTCI premium increases are typically "class-wide." This means an insurer can raise premiums for an entire group of policyholders if their actuarial projections show that the original rates are insufficient to cover future claims.

These aren't minor adjustments. Past rate hikes have ranged from 20% to 40% in a single jump, and some policyholders have faced multiple increases over the years. Imagine budgeting for a $2,500 annual premium, only to see it suddenly jump to $3,500 or more, year after year. For those on fixed incomes in retirement, such increases can be financially devastating, potentially forcing them to drop coverage after decades of payments – and losing everything they've invested. This unpredictable nature of future premiums is a significant financial risk to consider.

Paying for a "What If": The Unused Benefits Dilemma

This is a core psychological hurdle for many considering LTCI. You could pay substantial premiums for 20, 30, or even 40 years, never need long-term care, and thus never receive a payout. For some, this feels like a "loss" of investment, money that could have been used for other purposes, invested, or simply enjoyed.

While the primary purpose of insurance is to transfer risk and provide peace of mind – you hope you don't need it – the sheer volume of money involved with LTCI makes this a difficult pill to swallow. It's a gamble, albeit an informed one, on a future need that may or may not materialize. According to the U.S. Department of Health and Human Services, while 59% of people need unpaid care at home, only 35% spend time in nursing facilities, with an average stay of one year. This doesn't mean you won't need care, but it highlights the variability.

Inflation Protection: A Necessary But Costly Feature

Most long-term care policies offer an inflation protection rider, typically 3% or 5% compound annual growth, to help your daily benefit keep pace with rising care costs. This feature is almost universally recommended because care costs can double every 10-15 years.

However, opting for inflation protection can significantly increase your premium costs, sometimes by 20% to 50% or more over a policy without it. It's a critical trade-off: ensure your future benefits are adequate, but pay a much higher price today and indefinitely. Neglecting inflation protection, on the other hand, risks your coverage becoming woefully insufficient in 20 or 30 years.

The Fine Print Fiasco: Complex Policies and Hidden Limitations

Long-Term Care Insurance policies are not simple. They are contracts bristling with jargon, conditions, and caveats that can trip up even the most diligent reader. Understanding these intricate terms is paramount to avoid unpleasant surprises when you finally need to file a claim.

Navigating the Labyrinth of Policy Terms

Policies often contain a host of complex clauses that dictate when and how benefits are paid:

- Benefit Triggers: You can't just decide you need care. Policies require specific conditions to be met. The most common trigger is the inability to perform a certain number of Activities of Daily Living (ADLs) – typically two out of six (bathing, dressing, eating, toileting, transferring, continence) – without substantial assistance. Another common trigger is severe cognitive impairment (e.g., Alzheimer's or dementia). Proving these conditions often requires physician certification.

- Waiting/Elimination Periods: Similar to a deductible, this is a period (often 30, 60, or 90 days) after you qualify for benefits during which you must pay for your care out-of-pocket before the policy starts paying. A longer elimination period generally means lower premiums, but a higher initial self-pay burden.

- Exclusions: Policies will list specific situations or conditions for which benefits will not be paid. These can vary, but generally include things like self-inflicted injuries, mental health conditions not resulting from an organic brain disorder (e.g., severe depression, but often not dementia), drug or alcohol abuse, or care received outside the U.S.

Caps on Coverage: When Care Outlasts Your Policy

Many LTCI policies are not truly "lifetime" policies. They often come with caps on the total dollar amount they will pay out or a limited duration for benefit payments. Common benefit periods range from 2 to 5 years. While the average stay in a nursing facility is about one year, many individuals require care for much longer. What if you need 10 years of care? A 5-year policy would leave you exposed for the remaining five, potentially depleting the assets you sought to protect.

Ensuring your policy adequately covers your potential care needs and duration is critical. Opting for longer benefit periods or higher total maximums, however, will naturally lead to significantly higher premiums, circling back to the financial burden.

Limited Choice: Restricted Care Options and Facilities

Some LTCI policies may restrict the types of care covered or the facilities you can use. They might specify that benefits are only available for care provided by licensed professionals, in approved facilities, or within specific networks. This could limit your flexibility if you prefer informal care from a family member (who may not be a licensed professional) or wish to use a specific assisted living community that isn't on the insurer's approved list.

While most modern policies are quite flexible, it's vital to confirm that the policy aligns with your personal preferences for care types (e.g., in-home, adult day care, assisted living, nursing home) and locations.

Eligibility and Access Challenges: The Underwriting Gauntlet

It's not enough to simply want long-term care insurance; you also have to qualify for it. The application process involves stringent underwriting, which can be a significant barrier for many.

The Underwriting Hurdle: Pre-existing Conditions

Insurers evaluate your health history meticulously. They'll review medical records, ask detailed health questions, and may even require a medical exam or cognitive assessment. Certain pre-existing conditions, chronic illnesses (like advanced diabetes, Parkinson's, multiple sclerosis), or a history of strokes, heart attacks, or cancer within a certain timeframe can lead to:

- Higher Premiums: If you're deemed a higher risk.

- Modified Policies: With certain conditions excluded from coverage.

- Outright Denial: If your health profile suggests a high likelihood of needing care soon.

The younger and healthier you are, the easier it is to qualify and the lower your premiums. Waiting until you're older or have developed health issues significantly increases the chances of being denied or facing prohibitive costs.

The Opportunity Cost and Exploring Alternatives

Every dollar spent on LTCI premiums is a dollar that can't be used elsewhere. This "opportunity cost" is a critical aspect of financial planning.

Could Your Money Work Harder Elsewhere?

Consider the money you'd pay in LTCI premiums over 20-30 years. What if you invested that sum instead? In a well-diversified portfolio, that money could potentially grow, providing a substantial sum for any future need – be it long-term care, unexpected medical expenses, or leaving a larger legacy. If you never need long-term care, that investment would remain yours.

This isn't to say investing is always better; it comes with its own risks. But it highlights that LTCI is one option among many for mitigating long-term care costs. For those with substantial assets and a high tolerance for investment risk, self-insuring through investments might be a viable alternative.

Beyond Traditional LTCI: Exploring Other Paths

The landscape of long-term care planning has evolved, offering alternatives that might better suit certain financial situations or risk appetites:

- Hybrid Life Insurance and Annuities: These products combine a death benefit (like traditional life insurance) with a rider that allows you to accelerate the death benefit to cover long-term care expenses. If you don't use the long-term care benefits, your beneficiaries still receive a death benefit. This addresses the "use it or lose it" concern of traditional LTCI.

- Life Policies with Accelerated Death Benefits: Some standalone life insurance policies include a rider that allows you to access a portion of your death benefit while you're alive if you face a terminal illness or chronic care need.

- Reverse Mortgages: For homeowners, converting a portion of your home equity into cash through a reverse mortgage can provide funds to cover long-term care costs, allowing you to stay in your home.

- Medicaid Trusts: For individuals with specific estate planning goals, an irrevocable trust can be established to manage assets, potentially allowing you to qualify for Medicaid if extensive care is needed later, without fully depleting your wealth. This is a complex strategy that requires careful legal and financial planning.

Understanding these alternatives is key to deciding whether is long term care insurance worth it? for your specific circumstances, or if another path offers a better balance of protection and flexibility.

Who Should Be Wary: Suitability and Personal Context

Given these significant downsides, LTCI isn't for everyone. It's crucial to honestly assess your financial situation, health, and risk tolerance.

If You Have Limited Assets

For individuals with modest assets, the high and rising premiums of LTCI can be particularly problematic. If premiums become unaffordable due to rate hikes, you might be forced to drop the policy, having paid for years without any return. In such cases, if you eventually deplete your assets below a certain threshold, Medicaid might become your primary option for long-term care coverage anyway, making the LTCI premiums a sunk cost.

If You're on a Fixed Income

Retirees often live on fixed incomes. A sudden 30% jump in LTCI premiums can severely disrupt a carefully crafted retirement budget, potentially forcing painful choices between essential living expenses and maintaining coverage. The unpredictability of future premiums introduces significant financial instability.

The "Near Medicaid" Crowd

There's a tricky middle ground for individuals with assets that disqualify them for Medicaid now, but aren't substantial enough to comfortably self-insure or sustain potentially escalating LTCI premiums indefinitely. In this scenario, paying LTCI premiums might prevent you from ever qualifying for Medicaid, but the policy benefits themselves might not be sufficient for very long-term care, leaving you in a precarious position.

Addressing Common Questions and Misconceptions

It’s easy to misunderstand the nuances of long-term care insurance. Let’s clear up some common points of confusion.

"It's just like car insurance, right? You pay and hope you don't use it, but you're glad it's there."

While the core principle of risk transfer is similar, the experience of paying for LTCI is profoundly different. Car insurance is typically renewed annually, and the cost is relatively low compared to the asset it protects. If you stop paying, you lose coverage, but the financial "loss" is contained to that year's premium.

LTCI, however, involves decades of substantial, non-refundable premium payments. If you don't use it, the sum total of those premiums represents a significant amount of money that's gone. This "use it or lose it" aspect feels much more impactful with LTCI than with other forms of insurance, making the decision emotionally and financially heavier.

"So, my premiums will definitely go up?"

No, not definitely for you specifically, but the risk of "class-wide" premium increases is very real and has a documented history across the industry. These increases aren't tied to your personal health or claims history, but rather to the insurer's overall financial health and their ability to meet future obligations for an entire group of policyholders. While individual companies vary, and some are more stable than others, the possibility of a significant rate hike is a risk that every potential policyholder must acknowledge and prepare for.

"Can't Medicare or Medicaid cover this?"

This is a widespread misconception. Medicare provides very limited, short-term coverage for skilled nursing care or home health care, usually only after a hospital stay and for a maximum of 100 days under specific conditions. It does not cover long-term custodial care (help with ADLs) in most settings.

Medicaid does cover comprehensive long-term care, but it is a needs-based program. To qualify, you must have very limited income and assets, often requiring you to "spend down" most of your savings and assets to meet the eligibility thresholds. This is exactly what many people want to avoid with LTCI.

Making an Informed Decision: Practical Guidance

Navigating the complexities of long-term care planning demands diligence and a personalized approach. Here’s how to weigh the potential downsides against the benefits for your unique situation.

Self-Assessment: Your Health, Your Wealth, Your Needs

Before you even look at policies, conduct a thorough self-assessment:

- Your Health: Honestly evaluate your current health, family history of chronic illnesses, and any pre-existing conditions. This will impact your eligibility and premium costs. The healthier you are, the better your options.

- Your Financials:

- Income Stability: Can you comfortably afford the current premiums and budget for potential future increases (e.g., a 20-40% jump)?

- Liquid Assets: How much do you have in savings and investments? Could you self-insure for a certain period, or entirely? What are your goals for leaving an inheritance?

- Debt Load: How would premium increases impact your overall debt management?

- Your Care Needs & Preferences: What kind of care would you want? In-home, assisted living, nursing home? How long do you anticipate needing care (based on family history)?

Don't Go It Alone: The Value of Expert Counsel

Long-term care insurance is not a DIY project. Consult with:

- A Fee-Only Financial Advisor: Someone who isn't compensated by commissions on insurance sales can provide unbiased advice on whether LTCI fits into your overall financial plan, or if alternatives are better.

- An Independent Insurance Specialist: Work with an agent who represents multiple insurance companies, allowing them to compare various policies and find the best fit for your needs and budget. They can also help you understand the nuances of different policy terms and triggers.

Understanding the Fine Print Before You Sign

Never sign a policy without fully comprehending its terms. Ask your advisor or agent to:

- Clearly explain benefit triggers (ADLs, cognitive impairment).

- Detail elimination periods and how they work.

- Outline benefit maximums (total dollar amount and duration).

- Identify all exclusions.

- Discuss the insurer's history of premium increases.

- Explain how inflation protection works and its cost.

The "What If" Scenario: Planning for Premium Hikes

Build a buffer into your retirement budget specifically for potential LTCI premium increases. Don't assume your initial premium will remain constant. Ask your advisor about strategies to mitigate this risk, such as buying a smaller policy and planning to self-insure for the remainder, or exploring hybrid options.

Regular Review: Life Changes, Policy Needs

Your financial situation, health, and family dynamics can change over time. It's wise to review your LTCI policy and overall long-term care plan every few years with your financial advisor to ensure it still aligns with your current circumstances and goals.

Making Your Most Informed Decision

The decision to purchase Long-Term Care Insurance is deeply personal and financial. There are compelling arguments for its protection, especially in safeguarding assets and providing choice. However, ignoring the potential downsides and risks of long-term care insurance would be a disservice to your future self. High and rising premiums, complex policy terms, the possibility of unused benefits, and stringent eligibility requirements are not minor footnotes; they are critical factors that demand thorough consideration.

By understanding these potential pitfalls, engaging in honest self-assessment, and seeking expert, unbiased advice, you can navigate this complex landscape with confidence. Ultimately, the goal isn't just to buy a policy, but to build a robust, sustainable plan that truly secures your well-being and peace of mind in the years ahead.