Navigating the future of your health and financial well-being is one of the most significant decisions you'll make. When it comes to securing care in your later years, understanding the key factors when choosing a long term care insurance policy isn't just a smart move—it's an essential safeguard for your assets and peace of mind. This isn't about scare tactics; it's about empowerment, giving you the knowledge to make an informed choice for yourself and your loved ones.

Long-term care insurance (LTCi) is designed to provide financial support for services that assist individuals with daily living activities when they can no longer do so independently. Think of it as a strategic shield against the potentially staggering costs of care, helping you ensure access to quality options without depleting a lifetime of savings. But with various policy types, features, and financial considerations, how do you choose what’s right for you?

At a Glance: What You'll Learn About Choosing LTC Insurance

- Understand Your Options: Explore traditional, hybrid, and short-term policies to find the right fit.

- Decipher Policy Features: Learn about daily maximums, benefit periods, and elimination periods.

- Grasp the Costs: Get a realistic view of care expenses and how policy choices affect premiums.

- Identify What's Covered (and What's Not): See the wide range of services LTCi typically covers, plus common exclusions.

- Assess Eligibility: Know who qualifies and the pre-existing conditions that might prevent coverage.

- Plan Your Budget: Actionable tips for selecting appropriate benefit amounts and navigating inflation.

- Recognize the Value: Weigh the pros and cons to decide if LTCi is worth it for your situation.

Why Long-Term Care Insurance Matters More Than Ever

The reality is that many of us will need some form of long-term care as we age. Whether it's assistance at home, a stay in an assisted living facility, or comprehensive nursing home care, these services come at a significant cost. Medicare and standard health insurance typically don't cover these extended non-medical care needs, leaving many families to shoulder the financial burden alone. This is where LTCi steps in, offering a vital layer of financial protection.

Beyond the numbers, LTCi provides invaluable peace of mind. It lessens the stress on family caregivers, allowing them to focus on their relationship with you rather than the logistics and financial strain of providing care. It also gives you more control over your care choices, ensuring you can access the quality facilities and qualified caregivers that meet your standards.

Decoding the Different Flavors of Long-Term Care Policies

Not all LTCi policies are created equal. Understanding the main types is your first step in tailoring a solution to your specific needs.

1. Traditional Long-Term Care Insurance

This is the classic approach: a standalone policy focused solely on covering long-term care expenses.

- What it offers: Extensive coverage for various care services, often with a daily or monthly benefit limit.

- Considerations: Premiums may increase over time, and if you never need care, you won't receive a payout. It's a pure insurance product designed for a specific risk.

2. Hybrid Life Insurance with Long-Term Care Benefits

A popular choice, these policies combine the benefits of life insurance with long-term care coverage.

- What it offers: If you need long-term care, the policy taps into a portion of the death benefit to cover costs. If you never need care, your beneficiaries receive a death benefit. It's a "use it or lose it" alternative.

- Considerations: These policies typically have fixed or level premiums, providing greater predictability. LTC costs will reduce or eliminate the eventual death benefit.

Other Specialized Options

While less common as primary solutions for extensive long-term care, these policies can play a role in a broader financial plan:

- Short-Term Care Insurance: Provides coverage for a limited duration, typically for recovery after surgery or illness, usually for a few months to a year.

- Critical Illness Insurance: Focuses on specific severe conditions (like cancer or heart attack), offering a lump sum payout that can be used for long-term care costs, among other things. It's not specifically designed for ongoing daily living assistance.

- Indemnity Policies: These policies provide a cash benefit once a care need is triggered, which you can spend as you see fit—no receipts required.

- Reimbursement Policies: The more common type, these policies reimburse you for the exact amounts spent on approved long-term care services, up to your policy limits.

Essential Policy Features: What Do All Those Terms Mean?

When you delve into policy documents, you’ll encounter several key terms that define your coverage. Don't let the jargon intimidate you; these are simply the building blocks of your protection.

- Daily or Monthly Maximum: This is the cap on how much your policy will pay for a day or month of long-term care services. It's crucial to align this with local care costs.

- Benefit Period: This dictates the number of years you can receive the daily or monthly maximum benefit. Common periods range from two to five years, though some policies offer longer or even "lifetime" benefits.

- Benefit Pool / Lifetime Maximum: This is the total maximum amount of money your policy will ever pay out in benefits over its lifetime. Think of it as a bank account from which your daily or monthly benefits are drawn. Once this pool is depleted, benefits cease.

- Elimination Period: Similar to a deductible on health insurance, this is a waiting period (often 30, 60, or 90 days) after you qualify for benefits, during which you pay for your own care costs before the policy kicks in. A longer elimination period usually means lower premiums.

What Long-Term Care Insurance Actually Covers

Most comprehensive LTCi policies are designed to cover a wide array of settings and services, ensuring flexibility as your needs evolve. This broad coverage is a significant advantage.

You can expect coverage for:

- In-home care: This can include skilled nursing care, physical therapy, occupational therapy, and assistance with daily activities right in your home. It often covers necessary medical equipment too.

- Assisted living facilities: For those who need help with daily tasks but don't require 24/7 skilled nursing.

- Nursing home services: Both private and semi-private rooms are typically covered for more intensive, round-the-clock care.

- Community care: Options like adult day care, which provide supervised care and activities during the day, giving caregivers a break.

- Respite care: Short-term care designed to provide temporary relief for primary caregivers.

- Care provided by family members: In many cases, benefits may be paid to family members acting as qualified caregivers, offering financial recognition for their efforts.

- Home modifications: Essential changes to your home, such as wheelchair ramps or safety devices, to enable you to live independently for longer.

- Cognitive Impairment: Critically, care related to Alzheimer’s or other forms of dementia is typically covered, provided the symptoms appeared after the policy was in effect.

Common Exclusions and Limitations: Know What's Not Covered

While comprehensive, LTCi policies do have limits and exclusions. Being aware of these helps manage expectations and avoid surprises.

- Pre-existing conditions: Policies may not cover care related to conditions diagnosed before the policy's effective date, though the specifics vary by insurer.

- Non-medical services: Generally, services like basic housekeeping or companionship, without a medical component, are excluded.

- Waiting periods: As mentioned, benefits don't begin until your elimination period is satisfied.

- Geographic restrictions: Some policies might limit coverage to specific facilities or regions, especially if you move out of state.

- Certain medical conditions: While policies cover a broad range, some may permanently exclude benefits for specific severe forms of heart disease, cancer, or diabetes diagnosed pre-policy.

- Mental disorders: Generally excluded, with the significant exception of Alzheimer’s disease and other forms of dementia.

- Self-inflicted harm: Care needed due to alcohol or drug abuse, attempted suicide, or intentional self-harm.

- Government-related care: Treatment received in a government facility or government-paid treatment in a public facility.

- Acts of war: Illness or injury caused by an act of war.

The Financial Realities: Costs of Care and Policy Premiums

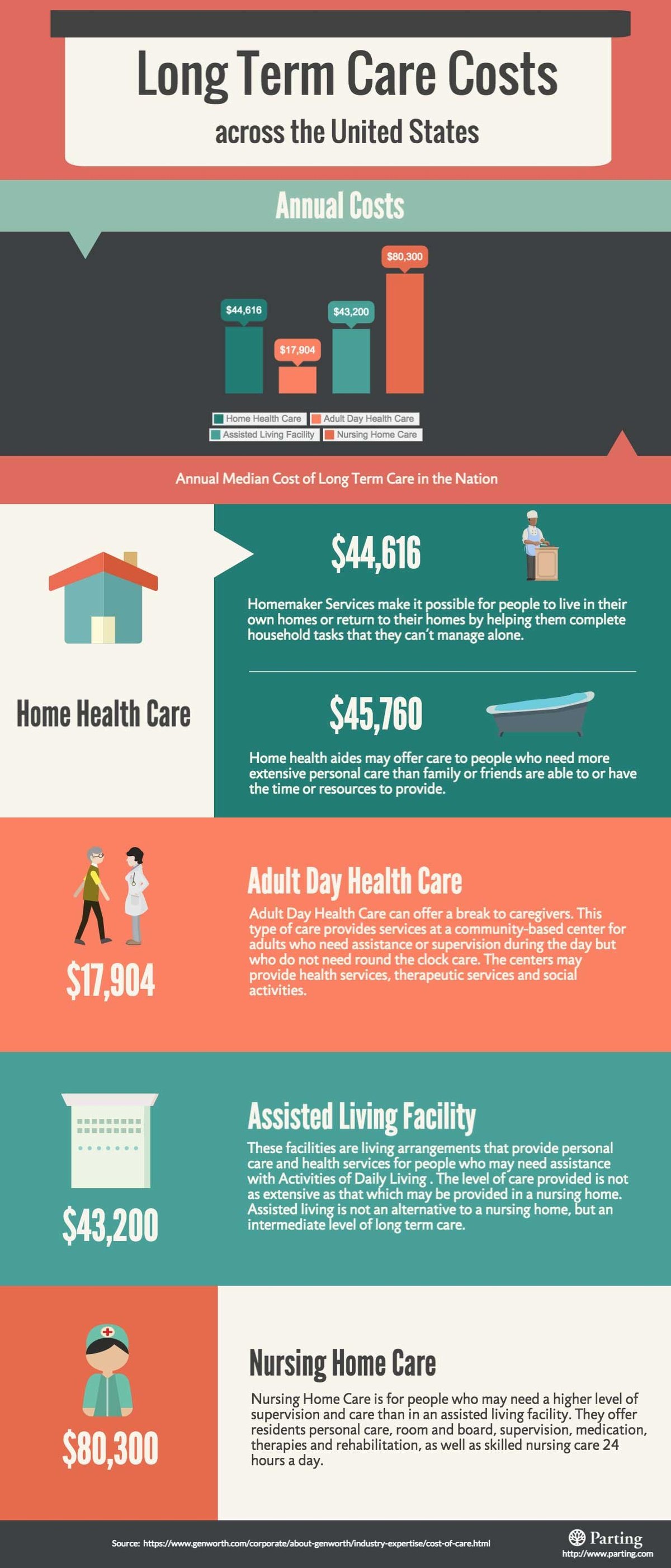

Let's talk numbers. The cost of long-term care is significant and varies widely by location and type of service. Understanding these costs is paramount when setting your policy's benefit amounts.

Average Annual Costs of Long-Term Care (U.S.):

- Semi-private room in a nursing home: $94,900

- Private room in a nursing home: $108,405

- One-bedroom unit in an assisted living facility: $54,000

- Adult day health care: $20,280

- Home health aide: $61,776

These figures highlight why considering the value of long term care insurance is so important for protecting your assets and ensuring access to desired care without financial stress.

What Drives Your Policy's Price Tag?

Many factors influence your LTCi premiums, so a personalized quote is always necessary.

- Age of the applicant: Younger applicants generally pay lower premiums because they'll pay into the policy for a longer period. Most people sign up in their 50s or early 60s.

- Benefit amount paid per day/month: A higher daily maximum translates to higher premiums.

- Benefit duration: A longer benefit period (e.g., 5 years vs. 2 years) will increase costs.

- Waiting period (Elimination Period): A shorter waiting period (e.g., 30 days) means higher premiums; a longer one (e.g., 90 days) will reduce them.

- Types of care covered: More comprehensive coverage typically costs more.

- Health status: Your health at the time of application is a critical factor. Healthier applicants receive better rates.

- Inflation protection: This is a crucial rider that automatically increases your daily benefit over time to keep pace with rising care costs. It adds to premiums but is often highly recommended.

- Location: The average cost of long-term care in your state or region can influence policy pricing.

Actionable Insight: Budgeting Your Daily Benefits

Don't guess when choosing your daily benefit amount. Be proactive:

- Research Local Costs: Call local nursing facilities and home healthcare agencies in your area to get their current long-term care costs. Ask for both private and semi-private room rates if applicable. This provides a realistic baseline.

- Assess Your Co-Insurance Capacity: Determine how much of the daily cost you can reasonably cover from your own savings. Ensure these funds are readily accessible. Your LTCi policy doesn't have to cover 100% of costs; it can be a significant supplement.

- Factor in Inflation Wisely: Inflation protection is essential, but don't choose an excessively high daily benefit assuming it will keep pace with rapidly rising costs. Focus on a reasonable current benefit with a robust inflation rider (e.g., 3% or 5% compound annual increase).

Unpacking the Tax Benefits of Long-Term Care Insurance

For many, the tax advantages of LTCi can be a significant draw, making policies more affordable.

- Premium Deductibility: If you have a "tax-qualified" long-term care insurance policy, premiums can be itemized as medical expenses.

- Age-Based Limits: The maximum deductible limit for long-term care insurance premiums is capped by age. For instance, in 2023, someone aged 61-70 could deduct up to $4,510, while those over 70 could deduct $5,640. These limits adjust annually.

- Adjusted Gross Income Threshold: Like other medical expenses, only the portion of your total medical expenses that exceeds 7.5% of your adjusted gross income (AGI) can be used as a deduction.

- Tax-Free Benefits: Benefits received from a tax-qualified policy are generally considered tax-free.

Always consult with a qualified accountant or tax attorney to understand how these benefits specifically apply to your financial situation. Tax laws are complex and can change.

Eligibility and Qualification: Who Gets Approved?

Not everyone qualifies for long-term care insurance, as insurers need to assess your health risk. The earlier you apply and the healthier you are, the better your chances of approval and lower premiums. Companies like Genworth and Mutual of Omaha are often highly rated in this space.

Who Generally Qualifies?

- Individuals with sufficient finances to comfortably cover ongoing premiums.

- Applicants who are in good health and do not yet need long-term care.

- Most people successfully apply in their 50s or early 60s.

Who May Be Denied Coverage?

Insurers look for existing health conditions or current care needs that indicate a high probability of imminent claims. You are likely to be denied if you are:

- Already using oxygen, a wheelchair, a walking aid, or requiring assistance with any Activities of Daily Living (ADLs).

- Currently needing assistance with Instrumental Activities of Daily Living (IADLs) like shopping, transportation, managing finances, or communication.

- Already receiving home health care, nursing home care, or assisted living services.

Disqualifying Pre-existing Conditions

While health underwriting standards vary between insurers, certain pre-existing conditions typically lead to denial:

- AIDS/HIV

- Alzheimer’s disease or other forms of Dementia

- Kidney failure

- Liver cirrhosis

- Muscular dystrophy

- Paralysis

- Parkinson’s disease

- Schizophrenia

- Sickle cell anemia

Understanding Activities of Daily Living (ADLs)

ADLs are fundamental self-care tasks, and needing help with a certain number of them is often the trigger for long-term care benefits. The six primary ADLs include:

- Toileting/Continence: The ability to get to and from the toilet, use it, and maintain continence.

- Bathing/Hygiene: The ability to wash oneself.

- Dressing: The ability to put on and take off clothing.

- Grooming: The ability to perform personal hygiene tasks like brushing hair or teeth.

- Mobility/Transferring: The ability to move in and out of a bed, chair, or wheelchair.

- Eating: The ability to get food from the plate into the body.

Generally, needing assistance with two or more ADLs, or severe cognitive impairment, is what triggers the need for professional long-term care services and policy benefits.

Weighing the Benefits: Pros and Cons of LTC Insurance

Deciding on long-term care insurance involves a careful evaluation of its advantages and disadvantages in the context of your personal situation.

The Upsides (Pros)

- Relieves Family Burden: Alleviates or prevents significant emotional, physical, and financial stress placed on caregivers and family members.

- Control Over Care: Provides you with more control over the quality, type, and location of care you receive, rather than being limited by government programs or available family resources.

- Asset Protection: Safeguards your savings, investments, and other assets from being depleted by high care costs, preserving your legacy for your family.

The Downsides (Cons)

- Cost for Limited Income/Assets: May not be feasible for individuals with limited income or under $200,000 in assets. For them, Medicaid might be a more realistic option if they spend down their assets. Also, there's a risk of losing coverage if premiums become unaffordable later.

- Potential Rate Hikes: Policyholders must be prepared for potential rate increases over the years due to inflation, changing market conditions, and insurer losses.

- Market Instability: The LTCi market has seen some uncertainty, with some insurance companies dropping out after experiencing losses, which can lead to policy changes or transitions for consumers.

Is Long-Term Care Insurance Truly Worth It for You?

The "worth it" question is deeply personal. While long-term care costs can be staggering and potentially bankrupt unprepared families, LTCi isn't a universal solution.

Generally, it IS worth considering if:

- You have assets you want to protect (e.g., $200,000 or more, excluding your primary residence).

- You want to maintain control over your care choices and avoid reliance on government programs like Medicaid.

- You want to relieve your family of the financial and logistical burden of your future care.

- You can comfortably afford the premiums without them becoming a financial strain.

It MAY NOT be worth it if: - You're too young: If you're younger than 50, paying premiums for many years could potentially offset the eventual benefits, or your needs and policy options might change significantly before you need care.

- You're very wealthy: If you have significant financial resources (e.g., millions in liquid assets) to comfortably pay for long-term care needs out-of-pocket without impacting your lifestyle or legacy, the insurance might be redundant.

- Premiums are unaffordable: If a policy costs more than 7% of your monthly budget, it could create financial hardship, leading to policy lapse and loss of accumulated value.

- You have very limited assets: If your assets are low enough that you'd likely qualify for Medicaid relatively quickly, paying for LTCi premiums might not be the most efficient use of your funds.

How to File a Claim: Your Roadmap to Receiving Benefits

The last thing you want to worry about during a time of need is navigating a complex claims process. Understanding the steps ahead of time can make a world of difference.

1. Understand Your Policy Details (Before You Need It!)

- Covered Services: Identify exactly which services are covered (e.g., in-home care, assisted living, nursing home care).

- Elimination Period: Know your waiting period before benefits begin, so you can plan for the initial out-of-pocket costs.

- Claim Triggers: Understand the specific conditions (e.g., needing help with 2 ADLs or cognitive impairment) that trigger benefits.

- Exclusions: Be familiar with any services or conditions not covered.

- Claims Process: Keep your policy document accessible and review the outlined steps for filing a claim.

2. Gather Required Documentation

When the time comes, efficiency is key. Prepare these items:

- Thorough Documentation Checklist: Create one based on your policy's requirements.

- Medical Records: You'll likely need documentation from a physician or licensed healthcare practitioner confirming your need for long-term care due to a chronic illness, disability, or cognitive impairment.

- Description of Services: Keep detailed records of the type, frequency, and provider of services received.

- Proof of Payment: Maintain invoices and receipts for all long-term care services for reimbursement.

- Specific Forms: Locate any specific claim forms required by your insurance provider well in advance.

3. Submit Your Claim Promptly

Once you've identified the need and gathered documentation:

- Review Submission Requirements: Double-check your policy for specific deadlines or preferred submission methods (online, mail, fax).

- Accuracy is Key: Fill out all necessary sections of the claim form completely and accurately. Incomplete forms can cause delays.

- Attach Supporting Documents: Include all medical records and invoices. Make copies for your own records before submitting.

- Follow Up: After submission, follow up with the insurance company to confirm receipt and inquire about the processing timeline. Don't be afraid to ask for updates.

Your Next Steps: Making an Informed Decision

Choosing a long-term care insurance policy is a significant financial decision that requires careful thought and research. It's not a one-size-fits-all product, and what's right for one person might not be ideal for another.

Start by assessing your personal financial situation, your health, and your family's needs. Talk to a qualified independent insurance advisor who specializes in long-term care to explore various policy types and features from different carriers. They can help you compare quotes, understand riders like inflation protection, and navigate the underwriting process.

By understanding these key factors, you're not just buying a policy; you're investing in your future dignity, financial security, and peace of mind for yourself and those you care about most.